Make no mistake, I like this version of merger mania better than the proposed DISH deal…

Make no mistake, I like this version of merger mania better than the proposed DISH deal…

Do I think Sprint would be ahead with SoftBank instead of DISH? I sure do – 300 YEARS ahead as a matter of fact.

When I was doing custom consulting the most fun I had was directing executive teams through their one, three and five year strategic planning sessions. I got to play consultant, standup comic and business partner all in one, while forcing people to think outside of their day to day paradigms. And since I was brought in as an outsider with a different point of view, it was fun as well as challenging.

That kind of planning doesn’t take place much anymore.

Not much seems to matter outside of quarter over quarter results and instant shareholder return these days. Short term matters more than long term, or at least that’s the impression most people have today.

Enter Masayoshi Son, the second-richest man in Japan, who loves being referred to as the Bill Gates of Japan. He thinks ahead. WAY ahead.

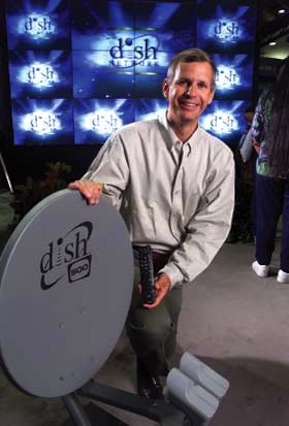

DISH CEO Charlie Ergen has what he says is a 10 year plan.

DISH CEO Charlie Ergen has what he says is a 10 year plan.

Son has a 300 year plan!

His “short term” goal is to invest in 5,000 companies by 2040. You read that right; 2040 is in his sights as the SHORT TERM vision. His management succession plan involves people who won’t even be born for three more generations!

Son’s most current target out of the 4,999 other firms he wants a piece of is Sprint.

“A person’s life is over in 50, 100 years,” Son said in 2010, as he updated a previous 300-year plan. “But a company lives on through the people it is composed of, and Softbank group has to survive even after I’m gone.”

Can a company really write a 300 year plan? Of course not.

If Alexander Graham Bell had written a 300 year plan after he invented the telephone, how could he have possibly seen even 50 years into the future?

If Alexander Graham Bell had written a 300 year plan after he invented the telephone, how could he have possibly seen even 50 years into the future?

There’s a striking difference between Son and DISH’s Ergen.

SoftBank is one of three major wireless players in Japan, but Son is clearly the personality, the leader with massive confidence and he’s seen as the foremost authority and visionary in his market.

Son was born in Japan to Korean parents. He came to school in the US at 16 to study at the University of California-Berkeley. He found his entrepreneurial skills there and then invented a multilingual translator that he sold for $450,000.

He then took that money and parlayed in into a burgeoning appetite for video games, importing bestselling Space Invaders machines from Japan and leasing them to college cafeterias here in the U.S.

If I sounded dubious last week about the DISH deal it’s because I think SoftBank is the better fit.

For one, Hesse and Son have known each other for years. They met in early 2001, if I recall, when Hesse was the big man at Terabeam Corp. – another telecom firm – and Son sat on Hesse’s Board of Directors.

So there’s a relationship already in place between those two, a good, strong one. And when dealing with the Japanese, relationships matter.

Second, SoftBank needs a presence in the United States and Kansas City is as good a place as any so the campus is almost certain to remain here. At the same time, I’d expect to see Hesse stay at the helm.

If you dig carefully dig through every press release you can find on the DISH proposal, there’s no “dish” on this topic. DISH is keeping silent on the topic of Sprint leadership and real estate. And if DISH isn’t speaking out on this, I’d assume it’s safe to bet several hundred Overland Park Sprint people would find pink slips in the inner office mail while many others would have offers to pack up and head for Denver or go home!

A good deal of the space on the Sprint campus is leased to others today as a result of the past Sprint employee shrinkage as the result of lay off after lay off. Still I’d hate to see it turn into another Corporate Woods.

A good deal of the space on the Sprint campus is leased to others today as a result of the past Sprint employee shrinkage as the result of lay off after lay off. Still I’d hate to see it turn into another Corporate Woods.

Key Bank, JP Morgan and Apria Health Care are all major tenants on a Sprint campus today that was once busting at the seams with Sprint employees. Sprint has become more of a commercial real estate broker and less a primary resident.

Son is a different dude.

He’s Japanese, but a more Americanized version having gone to school here. He’s articulate, speaks his mind, negotiates like a world class poker player with ice water in his veins and is a major humanitarian all at the same time.

Japan’s had its share of disasters of late, a nuke melt down, a tsunami, what more does one country need? But Son bellied up to the bar with $125,000,000 out of his own pocket in relief for his country and his people.

He took another step and donated all of his future salary to the kids displaced from the disasters who had lost their parents and now are orphaned!

Sure, maybe it doesn’t look like much, since he’s worth $7.7 BILLION, but he’s doing good for his people in a time of great need. That’s the mark of a man I’d be willing to follow into corporate battle. And Sprint needs to fight a corporate battle on several fronts!

If it goes this way, what’s Son likely to do first? Take a look at one recent quote; “I am a speed maniac,” Son has said, adding he “cannot stand the slowness of the speed” in the United States.

Japan uses the same LTE (long term evolution technology) that we use in the States; it’s just much better and much, much faster. Its second nature for Japanese to use their phones for everything, ticket purchases for the train or plane, buying from vending machines that line the streets, watching TV – the phone rules everything they do.

So expect to see Sprint being pushed to provide those same levels of speed and quality. And expect them to get the brain trust to help them get there.

“Son has been buying up companies one after another,” said Mitsuo Shimizu, an analyst at Iwai Cosmo Securities. “He’s very bold and takes a lot of risks to make Softbank bigger.”

I would expect him to find other, complimentary acquisitions in the US that would make Sprint even stronger.

What do I think Sprint will do? Sprint and SoftBank Corp asked the FCC to go ahead with a review of their proposed SoftBank merger as soon as DISH came on the scene with their offer. DISH, on the other hand, asked for a suspension of the review.

Sprint replied that its board will evaluate the DISH offer and told the FCC it was opposed to DISH’s request to delay the SoftBank review.

“The Commission must not be distracted by DISH’s latest maneuverings,” Sprint said in a document addressed to the FCC.

Yes, the DISH offer is for substantially more money, but does that mean anything in the end? DISH is already loaded with leveraged debt in excess of’ $11.6 billion! Add that staggering debt to Sprint’s already debt-laden spreadsheet and what’s that buy you? All you’ve done is increase the risk of both firms.

Yes, the DISH offer is for substantially more money, but does that mean anything in the end? DISH is already loaded with leveraged debt in excess of’ $11.6 billion! Add that staggering debt to Sprint’s already debt-laden spreadsheet and what’s that buy you? All you’ve done is increase the risk of both firms.

I don’t think that’s the point, but it’s most certainly the outcome if it goes that direction.

Softbank comes to the table with financial strength and cash. Lots of cash. Their offer would do nothing but strengthen Sprint’s balance sheet.

Also Softbank is strong in the telecom/wireless space; DISH is a TV satellite provider wanting INTO the wireless market

My money is on Sprint/SoftBank. I’ll go with deep pockets and subject matter experts any day of the week.

Well spank my mammasan. The telco wireless business sucks. It may be worse than the airline industry. There are no significant technology gaps that can’t be bridged. Not a lot of proprietary technology yet to be discovered in base services.

In the end, whenever that is, the war is going to be won by whoever controls the most content and will let you do whatever you do with your device for the least amount of money per month.

Telco wireless will wind up being a loss leader for whatever the content pimps want to sell you.

No Happy Ending to this story.

Smarty, you’re largely correct, but you still have to BE a player to deliver the content. There is some bridging the gap there. LTE is LTE, muuuuch is left to be done with content here in the US. You and I could retire off of one good app idea!

I’ve experienced the faster internet and wireless speeds in China and Japan.

I’ve been told the delay in getting that experience in the US is largely political and not technological.Streaming is just gonna kill everything

Your thoughts on that.

Smarty, I don’t know where the “political” roadblock would be. The FCC only allocates spectrum and spectrum utilization. All that says is this range is used for cell transport, this segment for TV broadcast band, broadcast radio, remote control airplanes, commercial business band, etc. I don’t know of any speed restrictions.

Much is technology. As I indicated last week, a good deal of motivation behind the Nextel merger was to get a technology platform that had near instant push to talk as opposed to the 1.5 second delay Sprints platform gave them. That was a pure technology issue.

All said, from my current knowledge base, it’s mostly technology.

Paul Wilson wrote: For one, Hesse and Son have known each other for years. They met in early 2001, if I recall, when Hesse was the big man at Terabeam Corp. – another telecom firm – and Son sat on Hesse’s Board of Directors.

So there’s a relationship already in place between those two, a good, strong one. And when dealing with the Japanese, relationships matter.

I say… YES! Excellent point. Relationships are important even in the multi-billion dollar world where Mr. Son and Mr. Hesse meet to pursue new ventures.

Thank you, Sonrise; we clearly see eye to eye on MOST issues. That’s all Ill say HERE!

Interesting article. I was under the false impression that Softbank would jeopardize local jobs more than Dish, based of Softbank being overseas. It sounds like just the opposite is true. I learned more about this from what you wrote than anything I saw on the news or read in the paper.

I gotta agree with Mike.

I picked up more here from the article and comments than I think I would have anywhere else.

Nice job.

Thank you, Mike and Chuck. I appreciate that.

Not having direct flights to/from anywhere in Asia is a big mark against KC as the permanent base for a potential Sprintbank. But I agree that Son’s deal has much more potential upside than Dish Network’s.

Expat, these guys come and go on their own G5’s at will, so whether or not were a hub for international flights doesn’t have much bearing on things. The rest connect in Chicago, Detroit or other choices.

It depends how far down ‘these guys’ stretches in the organization and how much flying to KC they need to do. Their English results don’t mention any corporate jets but considering the realities of travel inside Japan they are probably not outfitted as generously as someone from the US would expect (and I’m too lazy to read their JP statement to prove it).

Wilson, just got off the phone with my buddy Shoji at Samurai Geomancers in Kyoto. We met in the VIP Room at the Olympic Garden in Vegas back in 1998. They have the Feng Shui due diligence contract on this deal. The geomantic readings are off the chart for negative energy based on the longitude and latitude of the Sprint campus. They are chopsticks down on Obarandopaku.

Smarty, are you channeling someone we know in that comment? It sounds so familiar to a pseudo high roller who frequents this vaunted haunt.

The feng shui only needs one element. It has a stream running through it, open spaces, natural light. It’s only missing the key element of FIRE. Pretty soon someone is going to burn an effigy of Ergen; all will be balanced and good then.

Mr. Wilson,

What a pleasure as always! Reading your article was like listening to my daddy expound upon something. You really know how to help a girl out with understanding all this big talk. And you’re funny, too.

Paul, If I was with Sprint in a leadership position I would think twice about going to Dish! What you have said about this Japanese firm makes so much good, common sense! And I suspect that Sprint’s customer base would increase drastically with all the improvements this company sounds like it could bring to the table. I love reading what you have to say! It’s not above (most of the time) those of us who normally would not even think about corporate matters, much less understand them! I read somewhere that the best writing is done in a way that even a child could understand! I think that is probable true if you’re talking about 11-12 year old kids! Keep this up! You offer a good read for everyone! Stephanie