When in doubt, blame it on the Internet…

When in doubt, blame it on the Internet…

That’s pretty much how the game is played when it comes to old school businesses ranging from brick-and-mortar retailers to newspapers and magazines. They just can’t make money anymore because of competition from the worldwide web, they say.

“If you are a computer, chances are good that everyone kind of hates your guts right now,” writes blogger Jeff Vrabel.

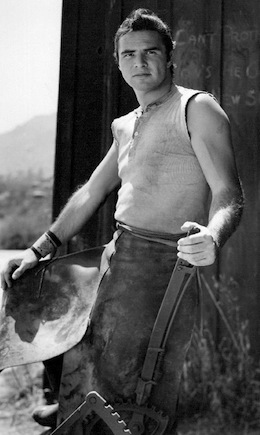

Hey, these are changing times, but for up-and-coming companies willing to take advantage of information technology, the sky’s the limit. But just like the horse and buggy repair shops that got their butts handed to them by the auto industry, if you can’t keep up with the times, you ain’t gonna make it.

Simple as that.

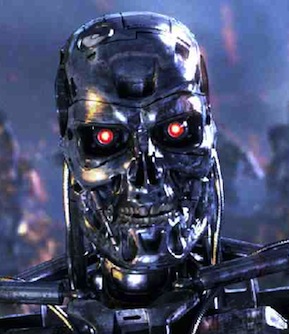

T he Bronze Age did the Stone Age in and the Internet’s taking down bookstores, electronics retailers, you name it. There’s nothing new here really, just survival of the fittest.

he Bronze Age did the Stone Age in and the Internet’s taking down bookstores, electronics retailers, you name it. There’s nothing new here really, just survival of the fittest.

The $64 million question:

Do up and coming Internet retailers owe local communities and the beleaguered businesses that operate within them anything? You know, like revenue sharing in professional sports.

Which brings us to an editorial in today’s Lawrence Journal World under the headline, “Tax Fairness,” that says they do.

“Local retailers – the lifeblood of local communities – may be on their way to getting a deserved break from the federal government…” it begins. “Many online sales are tax-free, to the dismay of competing merchants who maintain physical stores, and have all the expenses that go with them..it’s a matter of fairness.”

The Journal World’s bottom line?

“Congress needs to get this monkey off the backs of struggling local retailers and do away with an unnecessary advantage that fosters e-commerce to the detriment of businesses that invest in local communities across the nation.”

Since when did it become government’s responsibility to protect and subsidize outmoded businesses at the expense of newer, developing industries that are essentially the wave of the future?

For decades there have been businesses that advertise nationally – more often than not in magazines – that offered substantial discounts to prices local retailers have charged. Their economies of scale afforded them advantages that shrewd shoppers were keen to take advantage of.

It’s just more widespread now with the Internet.

Remember when there used to be camera stores?

Remember when there used to be camera stores?

The Internet didn’t wipe them off the face of the earth, competition did. Nobody protected them, they had to fend for themselves.

Competition from the Internet is remaking the way people shop for and buy stuff. Penalizing online businesses to try and help prop up fading retailers like Macy’s, K-Mart, J.C. Penney and others won’t hold back the hands of time.

There are plenty of ways for communities to derive tax revenue and for crafty retailers and businesses to market to consumers in the Age of Information. They just have to be smart about it, but what’s new about that?

Whining editorials like the Journal World‘s accomplish little beyond kissing up to local retailer advertisers in the hopes that the newspaper can continue to pull in enough local ad revenues to survive.

Whining editorials like the Journal World‘s accomplish little beyond kissing up to local retailer advertisers in the hopes that the newspaper can continue to pull in enough local ad revenues to survive.

However there will always be smart, capable local retailers who don’t need newspapers to make it. Those days have passed.

Because not only are the times a changing, they’ve already changed.

The first big battle in forcing on line “retailers” to charge tax is this: there would have to be some form or software that would calculate the tax codes in over than 9,600 jurisdictions! And codes that change daily. I don’t see that happening any time soon. At the very worst, I’d see something that exempts companies with $X in revenue and X number of employees if everyone needs a feel good solution, but as that great American prophet said, the times… they are a changin.

Anyone in favor of “WalMarts” raping and pillaging a local economy shouldn’t have an objection to this at all; they should be perfectly happy with internet retailers staying tax free! That’s where you separate the men from the boys in this one. Let the Big Box crumble under its own weight.

Interesting points.

Hadn’t really thought much about how so many retailers anymore build their houses of cards on taxpayer dollars.

But look, if consumers are increasingly going to make more and more of their retail buys online and do less and less wandering around malls and making impulse buys, cities are going to have to find other forms of revenue.

It does make one wonder.

Outside of clothes groceries, dining, drinking, dancing, comedy etc. we seem to be fast approaching doing much of our shopping online. It saves gas and time, what’s not to like.

Besides, at some point if everybody starts fighting over sales taxes, who’s to say the places where the sales are made and shipped from don’t deserve the sales tax revenue. Just like when you shop in Chicago, they get to keep your sales tax, they don’t send it back to Kansas or Missouri.

+1

Eliminate every tax; income, sales, personal property, gasoline, tobacco….all of them and institute a National Sales Tax of 20%.

I have said this for years and for years been told it is an idiot idea. But nobody can prove to me it’s an idiot idea when I pressure them to state why it’s an idiot idea. I always hear it would hurt the poor to much. And how is what we have now helping the poor? Be such a simple tax plan to put into effect. Maybe that’s the issue it’s to simple?

I always hear it would hurt the poor to much. And how is what we have now helping the poor?

————————————————

Ok I’ll bite.

It is a recessive tax, which means that it hurts the poor more. If revenue is collected by real property taxation, personal property taxation, or through income tax the poor pay less.

If you make under 32k a year you pay an effective tax rate of less than 10% as it comes back to you in your refund.

With a 20% across the board tax you are also taxing a bottle of baby formula at the same rate you are taxing a 50 foot jet boat.

Even the ~25% VAT of europe exempts stables and other necessity goods from taxation.